Net non interest margin formula

This means that 64 cents on every dollar of sales is used to pay for variable costs. Free Cash Flow - FCF.

Net Profit Margin Formula And Ratio Calculator Excel Template

Net Operating Assets Equity Short-term and Long-Term Non-Operating Debts Non-Current Operating Assets Financial Assets and investments Excess cash and cash equivalents.

. Net Debt To EBITDA Ratio. Net Income Formula Example 4. Only 36 cents remains to cover all non-operating expenses or fixed costs.

In the first resort the risk is that of the lender and includes lost principal and interest disruption to cash flows and increased collection costsThe loss may be complete or partial. Lets take an example to calculate the net profit margin. This ratio represents the percentage of sales income available to cover its fixed cost expenses and to provide operating income to a firm.

It is calculated by. According to our formula Christies operating margin 36. An MMM-Recommended Bonus as of August 2021.

Net Profit Margin 075. Formula calculations and examples. Free cash flow FCF is a measure of a companys financial performance calculated as operating cash flow minus capital expenditures.

In an efficient market higher levels of credit risk will be associated with higher borrowing costs. There are two main reasons why net profit margin is useful. Interest Expense 1500.

And net income in the income statement are compared to sales to understand gross profit margin operating income and net income as a percentage of sales. Alternatively it is known as the contribution to sales ratio or Profit Volume ratio. As you can see Christies operating income is 360000 Net sales all operating expenses.

This figure is calculated by dividing net profit by revenue or turnover and it represents profitability as a percentage. The income statement formula consists of the three different formulas in which the first formula states that the gross profit of the company is derived by subtracting the Cost of Goods Sold from the total Revenues and the second formula states that the Operating Income of the company is derived by subtracting the Operating Expenses from the total gross profit arrived. The net debt to earnings before interest depreciation and amortization EBITDA ratio is a measurement of leverage calculated as a companys interest-bearing.

Let us see the EBITDA Margin calculation The EBITDA Margin Calculation EBITDA Margin is an operating profitability ratio that helps all stakeholders of the company get a clear picture of the companys operating profitability and cash flow position. Operating Assets 15 025 125 million. A negative value denotes that the firm did not make an.

In which case it will incur significant interest expenses which will drive down its net profit margin. Net Profit Margin 45000 60000. Operating Profit Margin Formula.

Hillary and Chelsea Clinton get Gutsy for Apple TV Plus and Tom Hanks plays Geppetto in Disney Plus Pinocchio. Cobra Kai Returns to Netflix The Handmaids Tale Is Back on Hulu and Paramount Plus Has the Final Season of The Good Fight - Whats Upstream for Sept. FCFF Net Income Non Cash Charges Interest Expense 1 Tax Rate Investments In Working Capital Capital Expenditures CAPEX.

The net profit margin percentage is a related ratio. When net profit is divided by net sales the ratio becomes net profit margin. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and.

Non-Operating and Other. Net Profit Margin Formula. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Net profit margin is the ratio of net profits to revenues for a company or business segment. Net income can also be calculated by adding a companys operating income to non-operating income and then subtracting off taxes. Net profit margin is an easy number to examine when reviewing the profit of a company over a certain period.

Using the above formula Company XYZs net profit margin would be 30000 100000 30. The net profit margin is calculated as-Net Profit Margin Net Income Net Revenue. Please contact Savvas Learning Company for product support.

In the context of calculations of profit margin net income and net profit are used interchangeably. Using the financing approach it can be seen that the amount of net operating assets is calculated as the net amount of interest-bearing debts. Gross margin is a companys total sales revenue minus its cost of goods sold COGS divided by total sales revenue expressed as a percentage.

The net profit margin can be radically. We will first calculate the net operating assets of the company as below. What is net income.

Territories and Democrats Abroad. Net Working Capital Total Current Assets Total Current Liabilities. States the District of Columbia five US.

Net working capital 7793 Cr Based on the above calculation the Net working capital of Colgate Palmolive India is positive which indicates that the short-term liquidity position of the company is positive. Typically expressed as a percentage net profit margins show how much of each dollar collected by a. Suppose a company has a net income of 45000 and net revenue of 60000 in the year 2018.

FCF represents the cash that a company. Get 247 customer support help when you place a homework help service order with us. Net working capital 106072 98279.

The profit margin formula is quite easy to compute when one has two figures which are net profit and net sales. 8-14 Also streaming this week. Why Net Profit Margin Is Important.

Unit contribution margin per unit denotes the profit potential of a product or activity from the. Presidential primaries and caucuses were organized by the Democratic Party to select the 4051 delegates to the 2016 Democratic National Convention held July 2528 and determine the nominee for president in the 2016 United States presidential electionThe elections took place within all fifty US. Days in Inventory Formula.

Net profits Net sales x 100 Net profit margin. An equation for net income. Net Operating Assets Operating Assets Operating Liabilities.

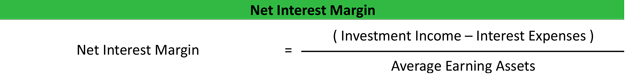

Net Interest Margin Formula. We can represent contribution margin in percentage as well. Shows Growth Trends.

The gross margin represents the percent of total. A credit risk is risk of default on a debt that may arise from a borrower failing to make required payments. Return on Equity ROE Formula.

Gain from Sale of Assets. The net sales part of the equation is gross sales minus all sales deductions such as sales allowances. EBI Earnings Before Interest Expense.

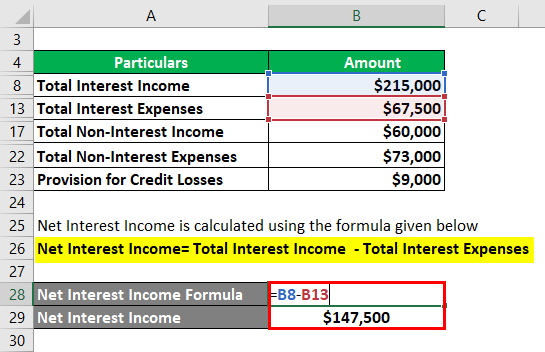

The only exclusion from these figures is any financing activities or significant cash balances that generate interest in bank investments. Net interest margin is a performance metric that examines how successful a firms investment decisions are compared to its debt situations.

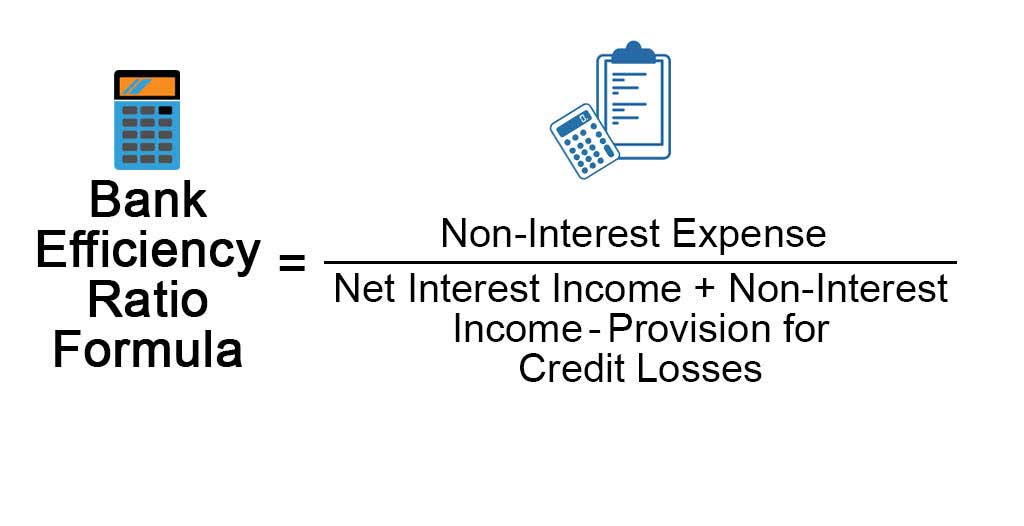

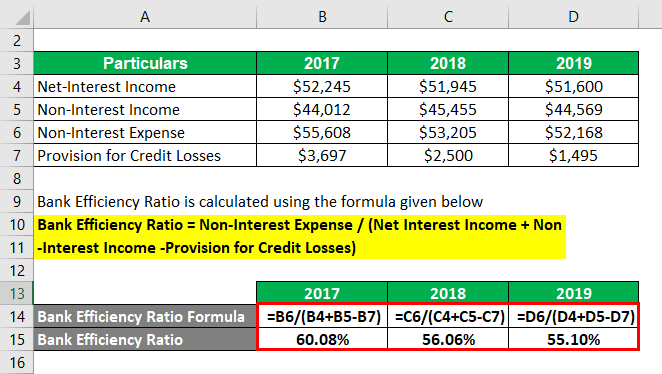

Bank Efficiency Ratio Formula Examples With Excel Template

Bank Efficiency Ratio Formula Examples With Excel Template

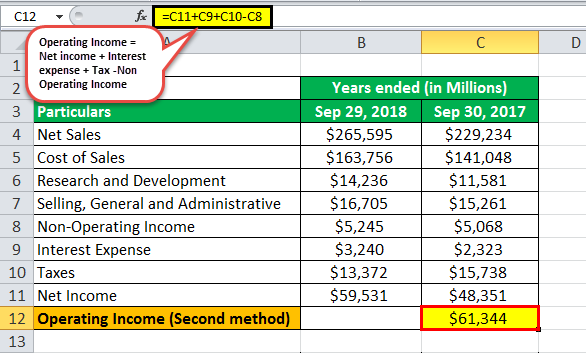

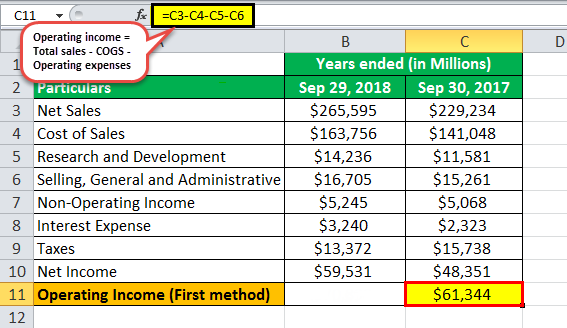

Ebit Margin Formula Excel Examples How To Calculate Ebit Margin

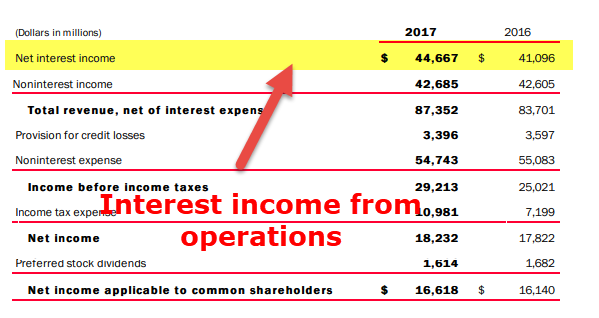

Interest Income Definition Example How To Account

Bank Efficiency Ratio Formula Examples With Excel Template

Net Interest Income Nii Formula And Calculator Excel Template

Ebit Margin Formula Excel Examples How To Calculate Ebit Margin

Net Interest Income Financial Edge

Net Interest Margin Nim Formula Example Calculation Analysis

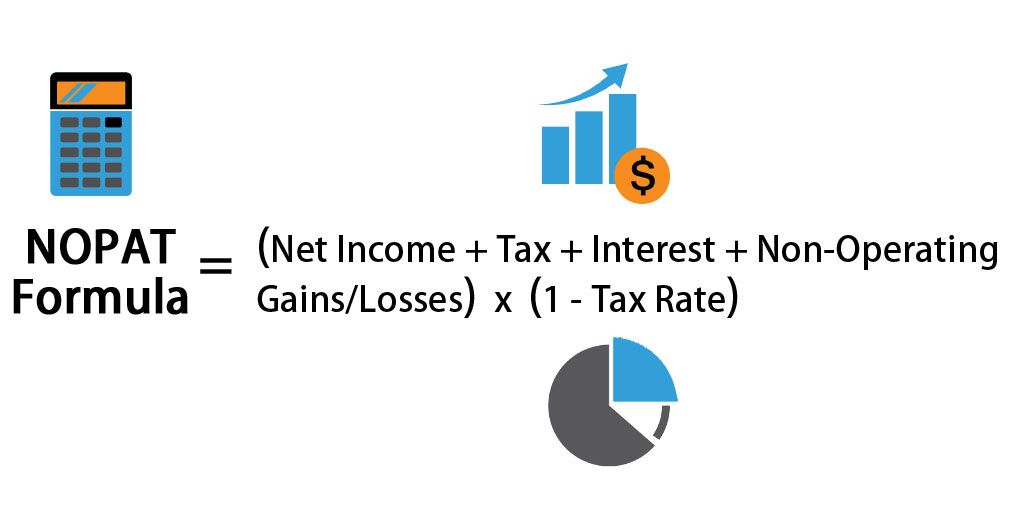

Nopat Formula How To Calculate Nopat Excel Template

What Is Ebitda Formula Example Margin Calculation Explanation

Bank Efficiency Ratio Formula Examples With Excel Template

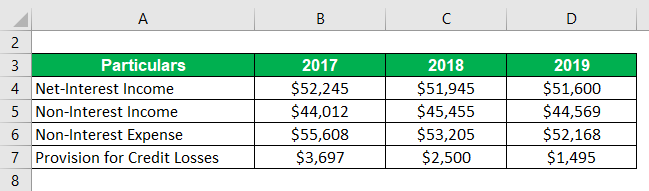

Non Interest Income Of Banks Definition Examples And List

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Net Profit Margin Formula And Ratio Calculator Excel Template

Net Interest Income Nii Formula And Calculator Excel Template

Net Interest Income Overview And How To Calculate It